Statistics on student loans don’t tell the whole story.

I’ve been doing research lately to understand more about the extent of the problem with student loans and their impact on former students. It’s easy to find lots and lots of articles highlighting the struggles on an individual level of borrowers who are struggling to pay their debt. However, I wanted empirical insights.

What I realized through this process is that there are really very few reliable sources for insights on student loans. And instead of someone and some organizations stepping up to get a better grasp on the state of student loans or publish true statistics (for instance, colleges publishing each year how many of their students took on student loan debt and how much debt they took on), we’re left with an unclear picture at best.

So, I thought I would hit on a couple good stats.

The Good Student Loan Statistics and What We Can Learn From Them

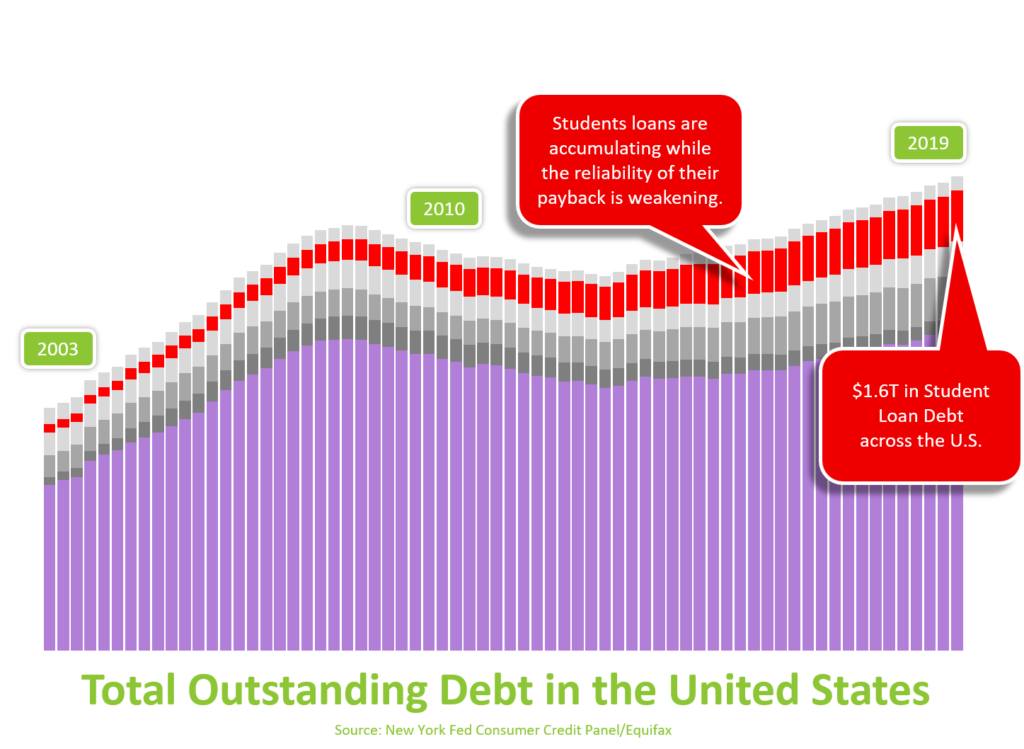

The New York Fed Consumer Credit Panel in concert with Equifax publishes a quarterly capture of all debt owed by Americans. This includes student loan debt (the red band), mortgage debt (the purple band), credit card debt, auto debt and other revolving debt.

We see two things happening in the chart above. First, around 2010, we see the band of accumulated student loan debt start to really take off. There are likely a few reasons for why student loan debt began to take off. If you think back to the 2008 Great Recession, many public colleges and universities saw their state governments slash budgets. This likely put pressure on colleges and universities to raise tuition to make up for shortfalls which in turn, means many students had to borrow more to pay for schooling. Also, it’s likely that many people who were impacted by the recession and lost their jobs enrolled in college at this time.

And then the debt kept accumulating. The concern is that we don’t see, even in the boom economy we’ve been having in the last few years, any discernible drop in the amount of student loan debt. In effect, more is getting added on than being taken off through repayment. And that can make sense if it only takes debt four years to pile on and ten to twenty years to pay it off. Nonetheless, today, we see that Americans hold a staggering $1.63 Trillion in student loan debt and growing.

If you think about the impacts of Covid-19 on the U.S. education system, we’ve likely entered a similar environment as to that of 2008. So, let’s take a look at another chart from the New York Fed.

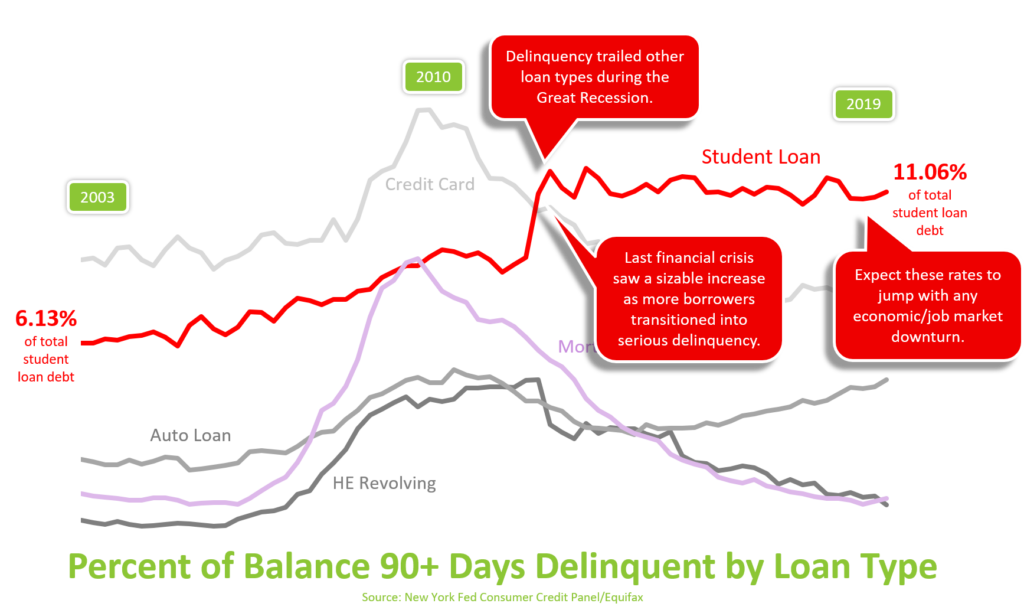

If one could make the argument that inevitably, we will have growth in student loan debt as more people attend college, this chart raises the alarms on that notion. What this chart shows is that 11% of borrowers are delinquent in their balances by more than 90 days. Notice the rise in the 2010 period that follows the Great Recessionary period.

The takeaway here is that as the delinquency rate rises, the quality of the debt overall erodes. In the past, it was advanced degree holders that made up 80% of all student loan debt. However, these people had a high potential income, strong job prospects and statistics bore out that they were very reliable payers. Today though, this is not as much the case as the cost of college has made it expensive just to borrow for an undergraduate degree let alone tack on an advanced degree.

Net net, that $1.6 Trillion in student loan debt is growing and becoming less and less reliable in terms of credit worthiness. And with the tragedy of Covid-19, it’s likely a safe bet to expect that we’re about to see another sharp rise in the overall default curve as seen in 2010 within the next 1 to 2 years.

What this means for students and parents is that we’ve entered a new period where it’s more important than ever to make smart choices when selecting the right college. Cost absolutely has to play a major factor in the consideration. Choice of majors and actual job prospects and likely salary have to play a major role in the consideration.

Other Statistics That Tell Small Parts of the Story

Often times, we see a statistic on the average amount of student loan debt students have coming out of undergraduate study. By the way, we used this stat too and it’s $29,200 and 65% of students coming out of undergraduate study had taken student loans (The Institute on College Access and Success). However, without richer data sets and tracking, we can’t tell the distribution. We don’t know how many borrowers there are above the average amount or if the average is pulled downward by a sea of small-scale loans or not. Because our fear is that there are many borrowers with a lot more than this amount but that the average is getting pulled down by very small borrowed amounts.

We just don’t know. The other issue here is that on the surface, $29,200 in borrowed monies doesn’t sound all that bad, right? Don’t get us wrong, it’s a lot of money. However, it seems totally surmountable to pay it back in ten or even less years. So, why is our sense that this isn’t happening and we keep hearing about people with a lot more debt, and taking longer and longer to pay it back?

The other side of the coin is that average student loan debt figures don’t tell you anything about the total cost of college including tuition and fees, room and board and other costs not included in room and board. The school might cost $100,000 overall. And if you’re a student with very little parental support financially, you’re going to be facing a much larger student debt. Your debt won’t just be $29,900.

And last but not least, these figures say nothing to the added cost of advanced degrees that may be recommended for your choice of major. So, if you come out with the average and go right into an advanced degree program, how much more debt and interest will you be accumulating on your way to what you hope is a great career?

Where the Uncertainty Leads Us

All of this uncertainty leads to two things in our minds.

First, there needs to be a national requirement for all of this information to be required for collection in a systematic and consistent away across all colleges and universities, and lenders both public and private. And the information needs to be made available to the general public to inform their decision-making as well as policy-makers.

Second, it’s up to the student and parents to understand what’s at stake in taking out student loans and make smarter decisions on their financial future when selecting the right colleges to attend.