The short answer is, “No, you shouldn’t get a credit card.” The long answer is, “No, you shouldn’t get a credit card.”

I remember when I was a student at Arizona State University and had the opportunity to get a credit card. I signed up right away and was given an initial $600 credit limit. I’d like to tell you that I paid the card off each month like clockwork so that any interest accrued was next to nothing. I’d like to tell you I was diligent in making payments in the first place but I wasn’t. I’d like to tell you I kept my balance very low at any time but truth was, I charged right up to the limit. I was a bit careless with my money because I didn’t budget. When I had money come in, it was spotty in terms of timing. And combined with my habits of eating out and overextending my bank account through costly ATM withdraw and overdraft penalties meant that I was living a student life of pizza one week and top ramen the next.

Now, you might say, “Hey, that’s not me. I wouldn’t do that.” And in fact, if you took the statistics from Sallie Mae’s Majoring in Money 2019 report, you might say my behavior was in the minority. Because most students indicate they are smart with their money with 72% saying their pay their monthly bills on time. Meanwhile, an astonishing 84% say their want to grow their “financial know-how.”

However, 57% of students have a credit card. Why? And is it a bad thing?

Having a Credit Card to Establish Credit

58% of the students in the study with a credit card indicated that they got a credit card as a way to establish a good credit rating.

We can’t but ask why establishing a good credit rating is so important for a student at this stage in their lives. Are parents suggesting this? In fact, the survey says 30% of parents of students with credit cards are suggesting it. Are credit card vendors saying this from their booth at the front of the school bookstore? Are other students repeating it and the message gets passed on over and over? We have no way to know.

As a student, why are you focused on creating a good credit history? Why not instead, start your adult life with an attitude that any debt is bad and that any choices to incur debt are well reasoned? Wouldn’t it be better if the student was smart at budgeting their expenses each month and avoided taking on any debt that carried such a high interest rate?

The truth is that other payments you make can contribute to your building a solid credit rating that don’t mean having a credit card. For instance, monthly payments on a lease, utilities or other monthly charges can contribute to the history on your credit report.

Establishing Your Credit Through a Credit Card Isn’t Free

If your sole reason for having a credit card is for establishing credit, is it worth it when rates can be from 17% to 25%? When your first priority is studying and doing well in school, why are students so fixated on credit cards in the first place when they come with such a high cost.

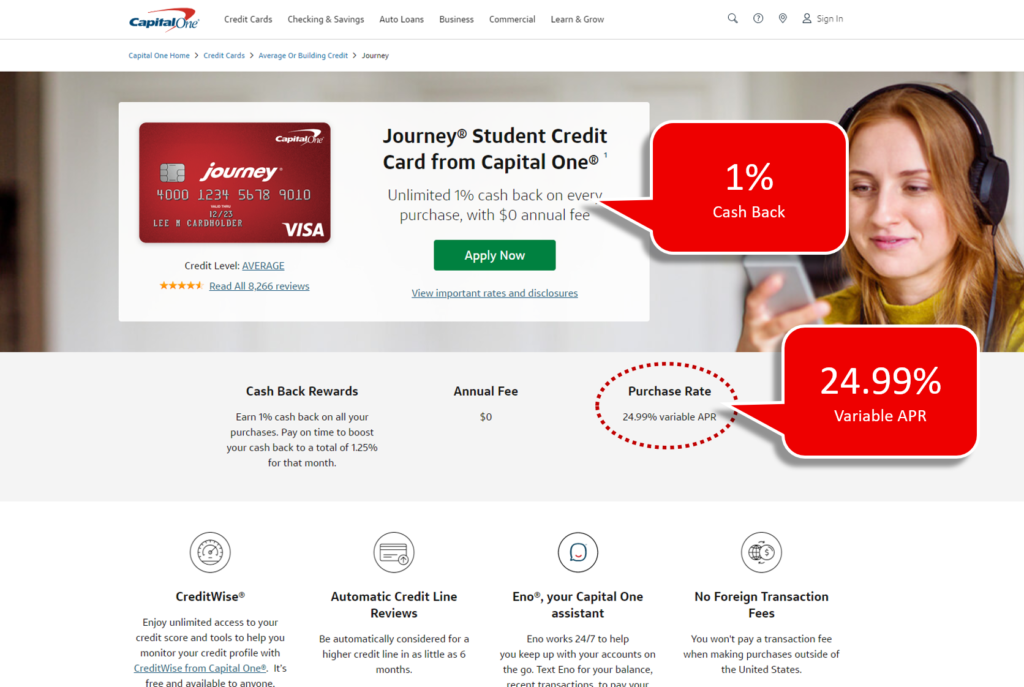

As an example, for this post, we visited Capital One’s website and searched on “student credit card.” Here’s the top result. Thanks to Regulation Z by the Consumer Financial Protection Bureau, credit card advertising has strict rules on disclosing APR rates and other fees. If you didn’t gulp at that interest rate, you should have.

You need to be asking yourself whether paying up to 24.99% interest to effectively borrow money is worth it. Or, if you practiced sound budgeting, you wouldn’t pay an interest to use your own money.

Credit Cards Build Rewards Toward Purchases

Ah, the rewards cards. Yes, we know them too. Whether it’s free airline miles or cash rewards, they make for attractive enticements to get a credit card for many Americans. However, are they really worth it?

It depends on you. If you’re someone who will pay off your balance each month without fail and avoid costly interest charges, then you can make the case that the rewards may give you real value back. However, if you’re not that person, then be prepared that the charges you incur more than make up for the rewards you get later. Ask yourself if the risk involved in getting the rewards is worth any extra cost that would accrue that would more than overtake the value of the rewards themselves.

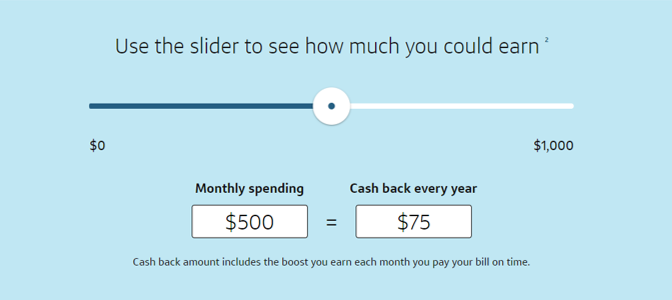

And let’s take a look at what rewards you might earn for your spending. Here’s a calculator Capital One placed on their web page advertising their Journey(R) student credit card.

For all the spending you would have to do and the risk and interest you take on, is it worth it to spend $6,000 over 12 months and only get back $75?

Just for the record, 60% of students with a credit card indicated they pay off the balance each month. We hope so but we’re a little dubious as to this high result. Regardless, the bigger point is why have credit cards at all instead of budgeting when the average card balance cited by students was $1,183.

2+ Credit Cards – Are You Serious?

In the Sallie Mae study, 68% of students that cited having a credit card also cited having more than one credit card. In fact, the average number of cards for card holders was 5.2 though the median was 2 cards. When asked why, students chose “Improve My Credit Score,” “Earn Rewards or Different Rewards,” and “Serve Different Purposes (i.e., one for every day, one for emergencies)” as their top reasons in order of importance.

We were astounded why students would think having more than one credit card would be necessary at all. Even if we assume that some students may be older, married and/or have families to support, we wouldn’t expect the results to be so high in this case.

By the way, the average credit balance of $1,183 cited earlier rises to $1,423 for the last month’s balance.

The Real Reason for a Credit Card?

Let’s get real. A lot of students think having a credit card is cool. It’s convenient and makes you feel like you have more money in your pocket should you need it. It’s instant gratification as well when you can buy something on the spot whether you have the savings to cover it or not. However, that so-called money ready in your pocket incurs a hefty penalty called interest and it’s somewhere around 18% per year.

Now, in some cases, a credit card may be used to smooth out expenditures, if monies come in unevenly, assuming you pay the balance off every month. Or, if an unexpected emergency charge should pop up. However, how often does this happen and could most cases be addressed by budgeting and having a small emergency fund set aside as well?

We challenge smart students to strive to go to college without a credit card and budget their money instead.

Source: Sallie Mae Majoring in Money 2019 Report