As we conduct research and speak with prospective students, we frequently come across so called “true cost of college” or “net price calculator” estimator tools. The main premise of all of these tools is to let you, as the prospective student or parent of a prospective student, understand what your costs may be based on historical data. Almost every college or university has on and there are several others easily found with a quick search of the internet. These are very good tools and useful in deciding which colleges might provide a good bargain for your educational dollars.

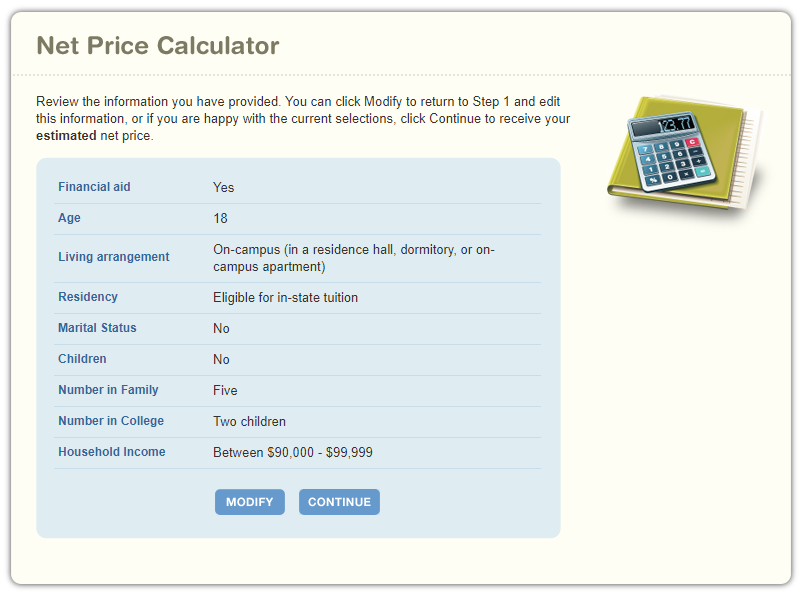

What I like about these tools is that they provide a good snapshot of costs and I do like the business-like approach of determining the best value. I strongly believe that when looking at colleges, you must consider them a business that are vying for your dollars as a consumer. Let’s take a look at a few tools in an example scenario with Georgia Tech in Atlanta, Georgia. For reference, I pulled all of this information on April 29th from the Net Price Calculator Tool on their website. (I pulled this information here on their website. The Department of Education Net Price Calculator Tool points to the instance is the same tool.)

In this example, we will assume I am an entering freshman from Georgia that plans to live on campus. I come from a family of five where two of us will be in college at the same time and our parents earn between $90 and $99K annually.

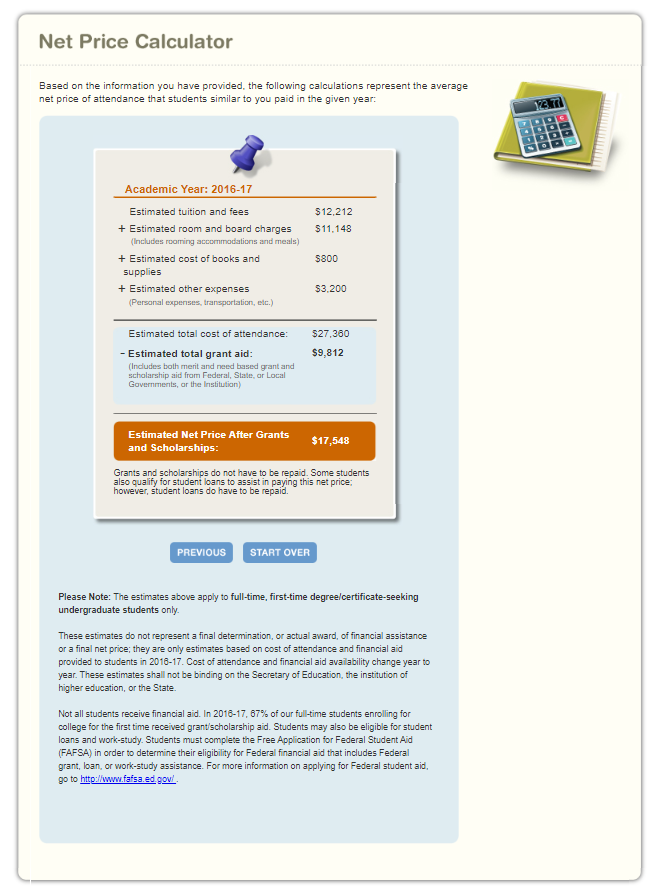

This is my result:

This is good information as it lets me know that if everything happens the way I plan, I can expect to pay almost $10K less a year.

The problem is that these tools aren’t guarantees and your results may vary. For example, if you live in the state of Georgia, you may be eligible to benefit from a higher level of the HOPE scholarship. Or, perhaps these grants already reflect the application of the HOPE scholarship and maybe you will not qualify for them. There are a lot of variables applied to these numbers and without detail, you can’t tell if these numbers really apply to you.

At the end of the day, these tool help guide you in applying for schools you might be able to afford. But, at the end of the day, these numbers may not come to pass in this way for you. Alternatively, just because a school is a “bargain” and offering you a “steep discount” with grants, it still may not be worth the final cost.

Even after a financial aid offer has been made, you still need to determine if you can afford the college or university you want to attend. Remember that just because a school offers you a tremendous package, it still may not be an affordable option for you. (See our blog on one student who had $40K a year in grants but would have drown in debt until well into her 30’s if she had chosen that school)

In other words, don’t count your chickens before they hatch and most definitely don’t set your heart on a college or university until you have all of the numbers in hand and a formal financial aid offer has been made. Once you have that offer in hand, carefully evaluate those offers to ensure you choose a school you can afford. If student loans are a part of the financial aid package, make sure you run a detailed financial assessment to understand how those loans will impact you after college. What looks like a golden package may sink you with debt payments for years to come. That’s not really a bargain in the long run!