Recently, I caught up with a past student client of mine and I was thrilled to see the decisions this young lady made and how it has set her on an amazing path. She was faced with a difficult decision and I would like to share her story with you.

The student loan debt you incur today impacts the money you will have available in the future.

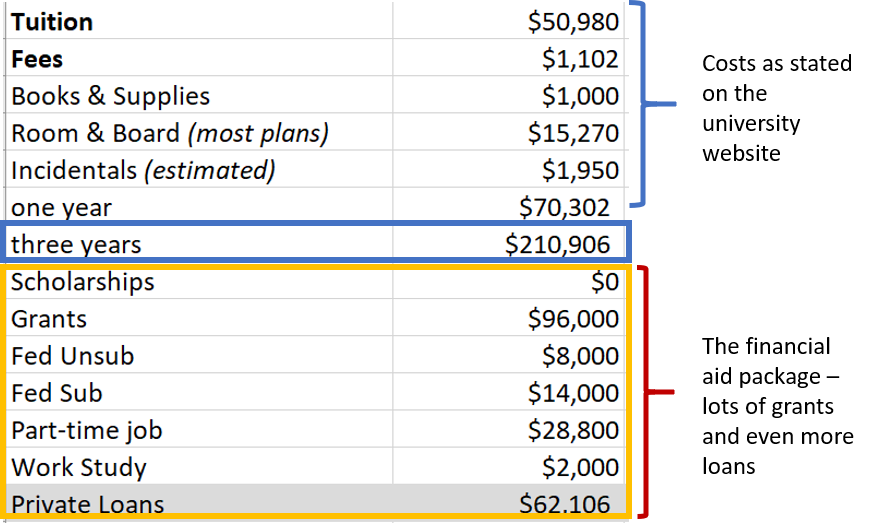

This student had an amazing grant package to a prestigious, east coast, private university she desperately wanted to attend. She had $32,000 a year in grants and she wanted to pursue a degree in Chemistry. She knew she would need a Masters degree at a minimum to do the kind of work she wanted to do so she was looking at 6 years of college. With her AP credits, she might be able to finish her undergraduate degree in three years and finish in 5 years.

Unfortunately, her parents were unable to contribute much to her college tuition but she believed she could make this university work because she had a very generous financial aid package full of low-rate student loans and, of course, those grants. As her dream school, she was heavily invested in making this work.

Here is her cost assessment for 3 years:

Let’s extrapolate this out. First, she would be walking away from an undergraduate degree with roughly $62,000 in loans, assuming she lives frugally and gets a part-time job to cover summer expenses.

Let’s make the following assumptions:

- Student loan repayment shouldn’t go on for more than 10 years, which is the standard term, or it starts to impact your life decisions and savings in your 30’s.

- Student loan payments should be 10% or less of your gross salary. Otherwise, after taxes, health payments, and 401K contributions, you won’t have enough to live on.

Now, let’s look at student loan payments. Taking each one of these types of loans and their associated interest rates, we come up with a monthly payment of $942 a month for 10 years.

$942 a month is a large number. We know at this point that she cannot afford to go to graduate school.

Let’s assume she starts working after her undergraduate degree. The average salary for someone with a bachelor’s degree in Chemistry is $45,000/year for their first year moving up to $66,000/year around year 5. Using a paycheck calculator, we can estimate the final paycheck minus taxes, health insurance, and 401K contribution. She would be taking home between $2000 and $2500 a month over this 10 year period. As you can see, her loan repayment is almost half of her projected take home pay.

Student Loan Repayment for a Chemistry Major

At this rate, this young lady would have a roommate at least until her early 30’s and will struggle to buy a car. Paying for the graduate school she needs is out of reach, even with the increased salary of a master’s degree.

So, what did this young lady do? She is just wrapping up her second year at a local state school. While this was actually her least favorite option, she’s made it work and it has worked out very well. She has a bright future ahead of her.

While this young lady wanted to study Chemistry, her real love is music. She is now pursuing a dual major in something she loves, music, which she would never have been able to do at the private university. Local band and orchestra contacts helped her secure a scholarship and she earns money playing in the university band and helping with the local student orchestra. More importantly, her smaller, independent scholarships go farther at a more affordable university. She is able to live at home and save on living expenses. She is on a path to graduate with no debt.

When this student and her family came to us, they were at loggerheads. At College Pathing, we believe that students are able to make good financial decisions when they are given the information to do so. This decision was a hard one to make, but it was her decision and she can take full ownership of the (amazing!) outcome.